Vanessa Dean

ABOUT ME

“I am committed to gaining knowledge for financial coaching clients”

I hold a Financial Counseling Certificate from Metropolitan Community College and am currently a Ramsey Solutions Master Financial Coach. While I’ve been trained through the Ramsey framework, I’m committed to expanding my approach with evidence-based strategies and ADHD-informed tools. As part of that growth, I’m an active member of the Association for Financial Counseling & Planning Education (AFCPE) and plan to sit for the Accredited Financial Counselor (AFC) exam in the fall of 2025.

✔ Financial Counseling Specialist

✔ AFC Candidate

✔ Money Management Essentials Certified

✔ Ramsey Financial Master Coach Certified

✔ Financial Peace University Coordinator

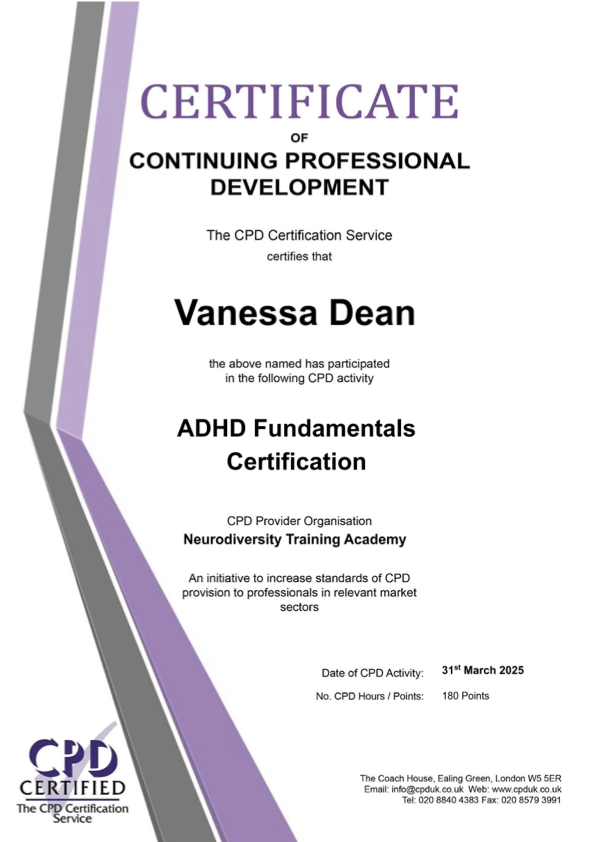

✔ CPD ADHD Coach (ICF accredited course)

Featured On

My Story

“If you want it, buy it” – this was the money philosophy Vanessa Dean grew up with, a mindset that would later fuel her passion for helping others break free from financial chaos. Vanessa’s childhood was marked by undiagnosed ADHD and dyslexia, a defining experience that taught her to embrace challenges. After joining the Army as a biomedical equipment technician, she learned self-discipline and attention to detail, but it was her personal financial crisis that revealed her destiny. With $24,000 in debt, four small children, and an impending military move from a house they were upside down in, Vanessa faced financial chaos head-on. As a stay-at-home mom with ADHD, she had to learn budgeting from scratch: comparing grocery prices, meal planning, and sticking to a budget until the debt was gone. Through this transformative experience, she discovered her calling to provide specialized money mindset and management support to help women with ADHD go from chaos to control.

As an ADHD Money Coach, Certified Financial Counseling Specialist, and former student of Dave Ramsey’s program, Vanessa brings both professional training and lived experience to her practice. She focuses on current money habits and goals to build personalized budgets for sustainable success, understanding that traditional financial advice often fails individuals with ADHD. Her approach empowers young professionals and upcoming retirees to take charge of their financial future, addressing the unique challenges that make money management particularly difficult for those with ADHD. She uses her own ADHD journey to help clients overcome debt and impulse shopping, diving deep into the "why" behind spending behaviors to create lasting change. As a homeschool mom of four with experience in balancing family and finances, she provides her clients with a safe space and hands-on help to reframe their mindsets and build budgets tailored to their brains. As a result, she transforms their relationship with money from chaos to control, helping them take back the freedom they deserve. Vanessa is also a speaker on the topic of ADHD and its unique impact on financial mindset and behaviors in women.

Understanding How ADHD Influenced My Spending

Dealing with emotional dysregulation—a common aspect of ADHD—greatly impacted my spending habits. After clearing my debt, I realized how essential it was to manage my finances effectively, which meant confronting the role ADHD played in my financial chaos. I needed to identify the executive functioning skills I was lacking, which had previously led to erratic spending and financial disarray. With support from those around me, I pinpointed these weaknesses and developed targeted strategies to address them.

As I dug deeper, I discovered that many of my financial habits were emotionally charged, driven by impulsive decisions and mood swings rather than rational planning. Recognizing these patterns was a crucial step in transforming my approach to money. Curious about how ADHD might be affecting your financial habits? Take this quiz to gain valuable insights and start addressing those emotionally driven spending behaviors.

Get started today.

Taking control of your finances doesn’t have to be a scary or lonely road. Book a free, no obligation friendly chat to see if we are a good fit to work together.